Overview: How Credit Card Processing Works

Before diving into the best merchant services companies, it is important to understand the back end of how credit card processing works so that the rules of the game are clear. View the video below for a brief outline and also for three tips or questions to ask a prospective merchant account provider.

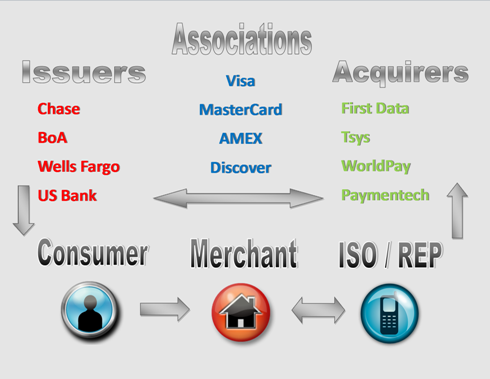

The diagram covering the payment cycle between issuers, associations and acquirers along with consumers, merchants and ISOs/Reps is depicted below.

Bank (Credit/Debit) Card Issuers

Bank card issuers include large national banks, regional chains and local credit unions that issue credit and debit cards to consumers. These cards are either tied to a bank customer’s checking account or line of credit with the correlating financial institution. Examples are…

Bank card issuers include large national banks, regional chains and local credit unions that issue credit and debit cards to consumers. These cards are either tied to a bank customer’s checking account or line of credit with the correlating financial institution. Examples are…

- Chase (JP Morgan)

- Bank of America (BOA)

- Wells Fargo

- U.S. Bank

The issuing side of the equation is what most people are familiar with. It is sometimes referred to as the front end of the process.

Card Associations

Card associations are networks of issuing and acquiring banks that process payment cards. This is the specific branding on the card typically in the bottom right hand corner. The card associations are responsible for regulating the industry including interchange rates.

Card associations are networks of issuing and acquiring banks that process payment cards. This is the specific branding on the card typically in the bottom right hand corner. The card associations are responsible for regulating the industry including interchange rates.

- Visa or “VC” (Merged and Branded in 1975)

- Mastercard shortened to “MC” (Founded in 1966)

- American Express abbreviated to “AMEX” (Originated in 1850)

- Discover or Novus (Announced by Sears in 1985)

- Diner’s Club International (Started in 1950)

- Japan Credit Bureau or “JCB” (Established 1961)

- China UnionPay (Created March 26, 2002)

Merchant Acquirers

Merchant Acquirers

Merchant acquirers are financial institutions or merchant banks that are sometimes referred to as Network Processors. Acquirers handle the movement of money from merchants back to issuing banks and vice-versa. By setting up a merchant account with an acquirer or designated sales organization, a business owner can accept credit or debit cards as a form of payment for goods or services. Examples include…

- First Data (Wells Fargo)

- TSYS Merchant Solutions

- WorldPay

- ChasePaymentech

For a full list of merchant acquirers check out our List of Acquirers post.

When choosing to work with an Independent Sales Organization (ISO) or direct representative for an acquirer, there are three questions that can help determine the quality of the company.

Insider Tips: Three Questions to Ask Prospective Providers

- How long have you been doing this?

- What are your service hours?

- Who are some of your clients?

While pricing is important, most companies can provide competitive industry rates. The more important factors to consider are service level and longevity. Refer to the video for more detailed explanation.

Speak To A Specialist -

Speak To A Specialist -