As detailed in the History of Electronic Money, Card Payment has been around since the 1900’s, although back then it was oil companies and department stores that issued their own proprietary cards. It was not until the 1950 when the modern plastic card first emerged. Since its inception card payment has been marketed as a dual purpose consumer tool. On one hand the extension of funds and on the other the extension of convenience. Today we find this evident in the split between Credit and Debit (Check) Cards. As of 2004 debit card transaction volume has surpassed credit, according to Visa. (Jump to Debit Card Processing)

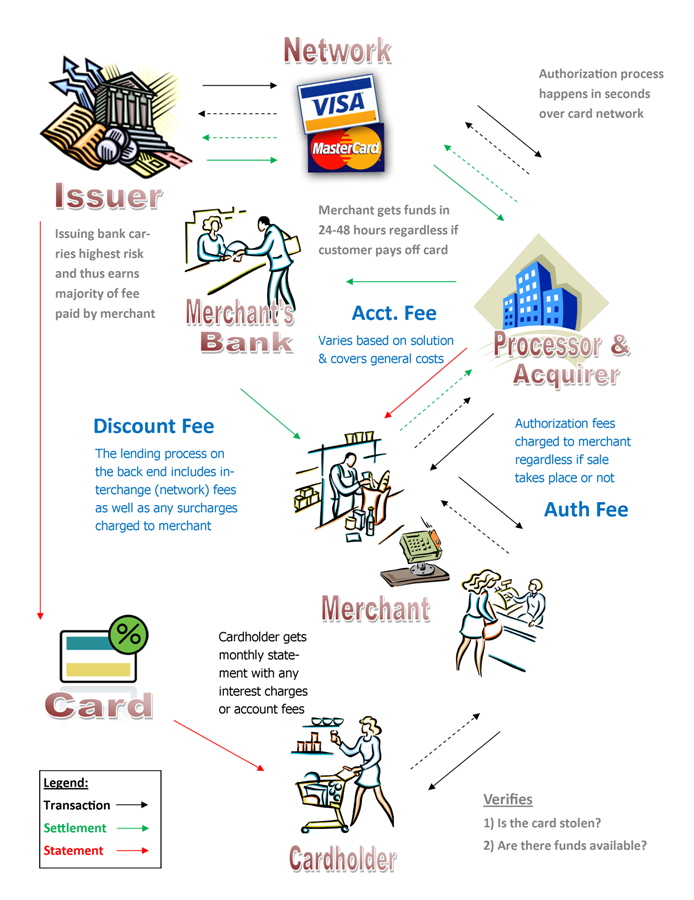

For simplicity let’s take a quick look at credit and how a transaction / funding works in credit card processing. See the chart below for a simplified version of how credit card processing works and what fees are incurred. This is a simplification of a very complex process designed to convey the concepts.

Also view this video from CreditCards.com for another more linear view of the process.

The above process varies slightly for American Express and debit cards.

(Click here to go to debit card processing)

What does Total Merchant Network bring to the table?

One of the largest costs drivers to the discount fee that merchants pay is the interchange costs associated with different types of payment cards. Total Merchant Network brings over 10 years of industry experience in determining the right solution for businesses that will both minimize costs and increases process efficiency. Total Merchant Network goes directly to the acquiring banks and the card networks and negotiates the best rates as well as the lowest monthly costs possible.

Contact Total Merchant Network today for a free 30min preliminary needs analysis to help determine the right solution for your business. Call us at 866.382.2819 or Click Here.

If you are ready to apply for merchant account to process credit / debit cards click here

Speak To A Specialist -

Speak To A Specialist -